От халепа... Ця сторінка ще не має українського перекладу, але ми вже над цим працюємо!

The Top 10 fintech startups from Web Summit 2022

Andriy Tsebak

/

Co-Founder & BDM

6 min read

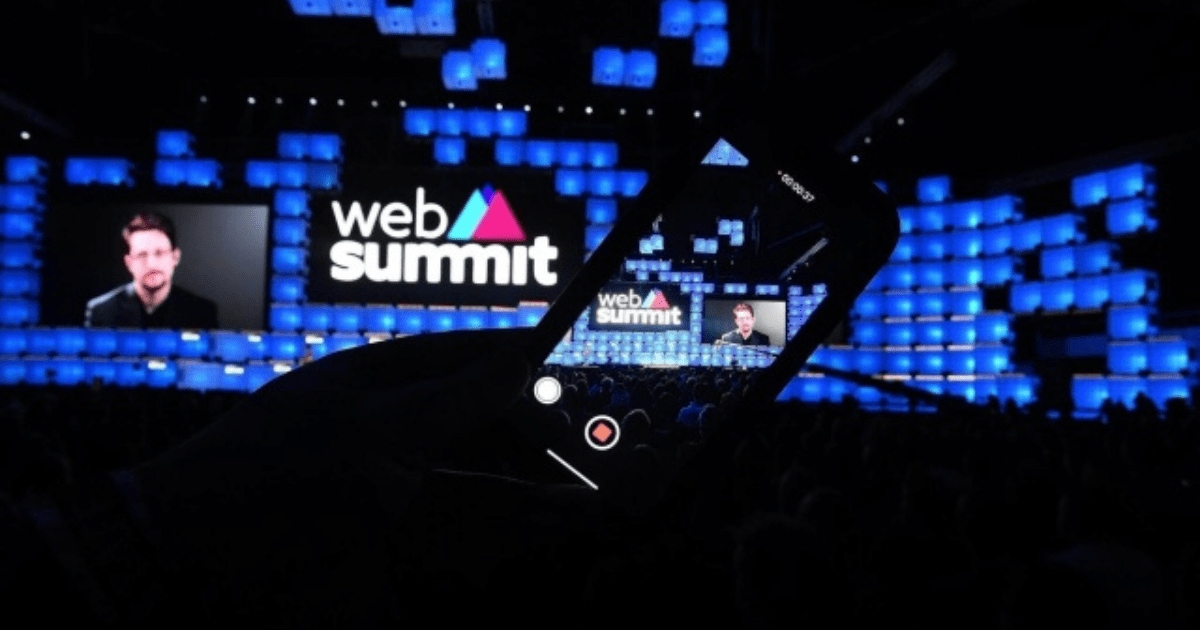

Web Summit, held annually in Lisbon, Portugal, is the largest tech conference in the world. The first Web Summit was held in 2010 and attracted around 400 attendees, and the event has since grown, with the 2022 conference attracting 71,000 people and companies who flocked to hear talks from some of the world’s leading innovators.

Web Summit 2022 took place from November 1-4 at Altice Arena. It featured more than 2000 startups, 1000+ investors, and 300 partners and brought more than 900 speakers from around the world to the podium.

Undoubtedly, Web Summit is an event that gives startups their first opportunity to showcase their businesses on a global stage. The schedule usually offers a range of activities designed to help startups make their mark, from mentoring to pitching projects and making great business connections.

Content:

Where’s FinTech going?

The rise in dominance of digital and mobile has ushered in a new era for financial services. It has freed up the customer to do financial transactions on the go and change their minds as quickly as they might change their clothes. It has allowed a level playing field for new entrants in their own right (e.g., peer-to-peer lending), but it also will enable banks to collaborate with tech vendors who offer a more comprehensive range of services than ever before.

Now the focus is shifting to broader access to funds for juniors, minorities, SMEs – and asset diversification for investors. The below-mentioned technologies are accelerating the industry’s pace in this direction.

See also: How to develop a strategy for startups and not only

Web3, DeFI, and smart contracts

Web3 is one of the latest technologies that has been making waves in fintech. It is a decentralized peer-to-peer network, which means no central authority controls it. Web3 apps can be accessed via browsers or dedicated software connecting to this network.

DeFi (Decentralized Finance) is an extension of Web3. It refers to applications built on top of this platform that offers financial services like payments, loans, and insurance between users without any middleman intervention. The ecosystem has been snowballing in the past couple of years and is expected to keep expanding.

API Integration and Open Banking

Open Banking is essential for startups and fintech companies to build innovative applications. It allows them to leverage existing infrastructure from banks or other financial institutions, reducing time and cost. It also helps startups gain access to new customers by developing more convenient solutions than banks provide directly.

The technology behind Open Banking is called Application Programming Interfaces (APIs). These are sets of rules that allow two systems to communicate with each other.

In the simplest terms, these sets allow developers to get access to bank account data to build innovative new apps with better services through third-party application data.

See also: a product design development case study for a digital wealth management platform

Biometric authentication

Biometric authentication technology involves using fingerprints, voice recognition, or facial recognition instead of traditional passwords to identify customers when they login to their accounts. This makes it harder for hackers to gain access because they can’t simply guess the user’s password, which contributes to higher online banking/investing security. At the same time, it reduces costs associated with managing accounts at financial institutions due to less fraud risk being involved.

Although gathering momentum in recent years, the technology needs to gain wider adoption among consumers, businesses, and financial institutions.

All these trends, one way or another, are represented in the startups we’ve covered in the review you’re about to read.

10 notable startups hitting Web Summit 2022

My-Money is a biometric payment system. It provides an app to bind all of a user’s payment methods, establish their preferences, and register a user’s fingerprint, which then can be used when paying. The app also allows for linking multiple banking accounts and creating a junior sub-account. By doing so, the startup cares about the environment (by reducing reliance on plastic cards, for example) and reduces the financial fraud risk.

PitchedIt created a network that connects investors, mentors, and startups. Startup founders get feedback from mentors about their pitches in written and audio form in real-time, while the platform’s proprietary validation technology assesses their ideas. At the same time, investors have an opportunity to support insightful ideas.

Finmap is a Ukrainian fintech startup offering a cash flow management platform for businesses. The service tracks all incomes and expenses from different sources allows the drawing up of balances and calculation of profits with analytics tools, and keeps all the data encrypted in the cloud for better security.

See also: Accessibility in mobile development: Creating an app for everyone

Wallstreeters is a platform that creates widgets for market dashboards for stocks, cryptocurrencies, and ETFs. In addition to constant asset market tracking and analyzing, the application also allows integration with multiple asset broker systems through APIs or CSV reports for broader portfolio diversification.

Splint Invest is a platform that offers to invest in alternative assets like rare whiskey, fine wine, and luxury watches. Having an opportunity to start investments from £50, users can trade their stocks or hold them until asset sale. With this approach, the company strives to diversify the assets market and decrease the inflation on investments.

EthicHub is a blockchain-empowered p2p marketplace that connects smallholder farmers with traditional and crypto investors and big lenders. Applying the technologies of DeFi and smart contracts for global transactions, the platform secures the farmers’ access to formal credit with minimum risk.

See also: Security in Android: How to build a safe application

impactMarket is a Web3-based ecosystem for supporting vulnerable sectors of the worldwide population through funding and literacy assistance. Operating as a Decentralized Autonomous Organization (or DAO) and using smart contract technology combined with its proprietary one, the platform raises and distributes funds from donors, enabling them to define and influence future protocol usage.

Fintech for International Development (or F4ID) created a biometric-empowered digital platform that connects NGO-backed supply and service providers with needy households. It focuses on last-mile environments, using the biometric cryptography solution to enable access to the food supply, education, and healthcare services and eliminate fraud, InfoSecurity, and diversions-related risks.

everifin is a fintech startup that provides multiple banking solutions for financial institutions. Embracing API integration and Open Banking technology, the startup wants to create a single and unified network of European banks through consolidated banking accounts and direct payments and transfers.

Green Mining DAO is a DeFi-empowered platform for extracting BTC cryptocurrency. Using the hydro-energy and solar energy supply instead of the resource-consuming regular one, the company gives access to decentralized decisions and tradable assets in a global community.

The new beginning

At NERDZLAB, we’ve been excited to see how the fintech startup space is developing and where it will extend to in the upcoming years. And there’s so much yet to come!

If you have a great idea and want to be among those who are changing the fintech industry for the better, drop us a line, and let’s do something great together.

*Thanks for the photo VADIM PASTUH